Budget

Build Your Budget

Build your brighter tomorrow with smart budgeting.

Simplify your finances with the GreenPath Build Your Budget tool, designed to help you manage your money with confidence.

- Track and Categorize: Record all income and expenses, distinguishing between fixed and variable costs.

- Set and Prioritize Goals: Align your budget with financial goals and prioritize saving at least 20% of your income.

- Plan and Prepare: Allocate funds for emergencies and minimize debt by focusing on paying off high-interest obligations.

- Review and Adjust: Regularly review and adjust your budget to stay aligned with your financial situation and goals.

Common Budgeting Methods

Online Banking Budget Tool

Plan, track, and save with ease.

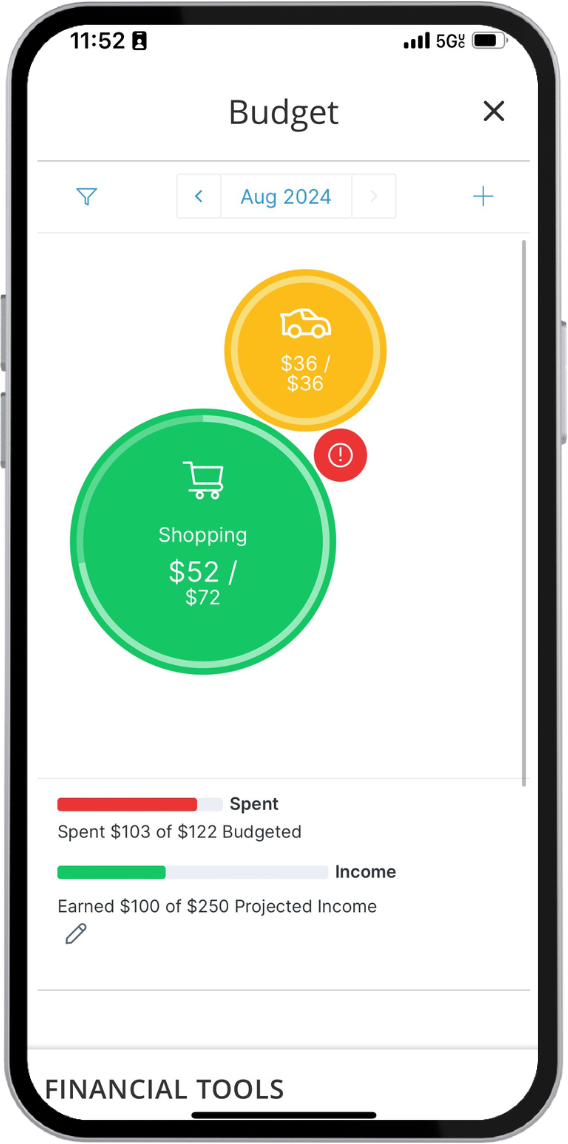

Stay in Control of Your Finances with Our Online Budgeting Tool:

-

Automatic Categorization: Instantly sort your transactions into categories like groceries, entertainment, and bills, making it easy to see where your money goes.

-

Customizable Budgets: Set personalized budgets for different categories and track your progress throughout the month.

-

Goal Tracking: Create financial goals, such as saving for a vacation or paying off debt, and monitor your progress directly in the app.

-

Spending Alerts: Receive notifications when you're nearing your budget limits, so you can stay on track.

-

Secure and Private: Your financial data is protected with top-tier security measures, ensuring your information is safe.

Get started:

- In the mobile app: Select "financial tools"

- Online banking: Select '"financial tools"

Not enrolled in mobile or online banking? Use our quick enrollment options to get started.

Empower Your Financial Future

Empower your financial journey with security and confidence, paving the way for a brighter financial future.

For members looking to build credit, this loan lets you save while making payments, accessing funds once paid.

Work with a certified financial coach to review your financial situation to develop a customized budget and money management plan focused on your goals.

Discover financial freedom with a creditworthiness tool unlocking new opportunities.